Social Security Employee Tax Limit 2021

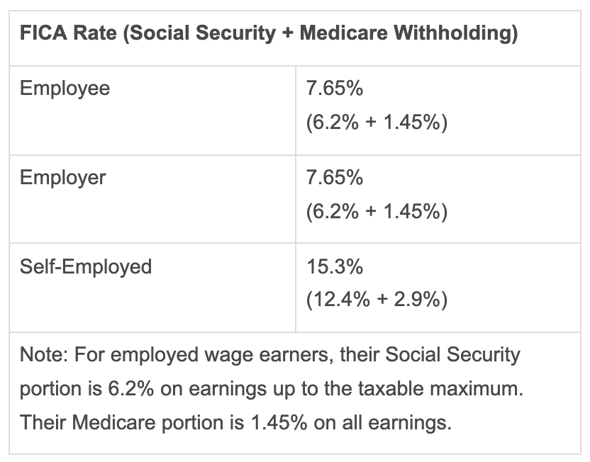

The taxes imposed on social security tax will be 62 and 145 for Medicare tax for each employee with matching contributions from their employer. FICA taxes are divided into two parts.

Your Bullsh T Free Guide To Taxes In Germany

Information for people who receive Social Security benefits.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Social security employee tax limit 2021. Social Security limits payroll taxes to the first 110100 of your income -- the wage base limit Any income above this amount is not subject to Social Security tax although it is still subject. Based on the increase in the Consumer Price Index CPI-W from the third quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. Are greater than 142800 the amount in excess of 142800 is not subject to the Social Security tax.

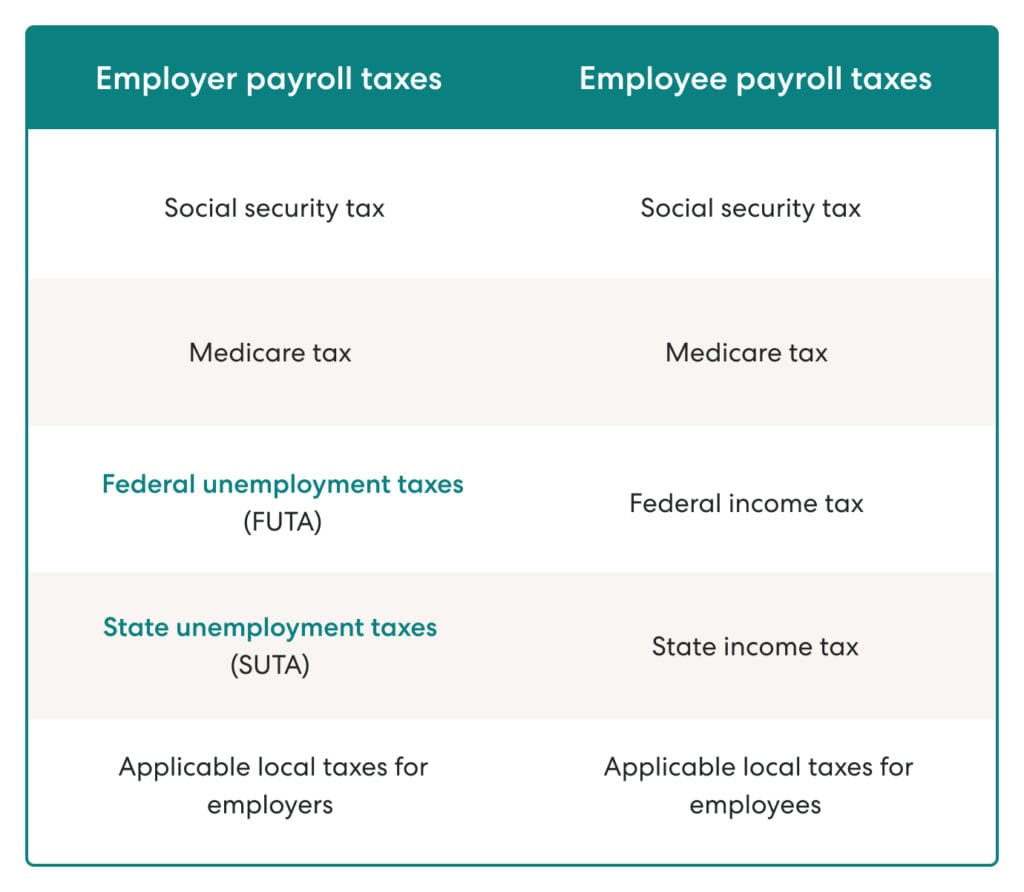

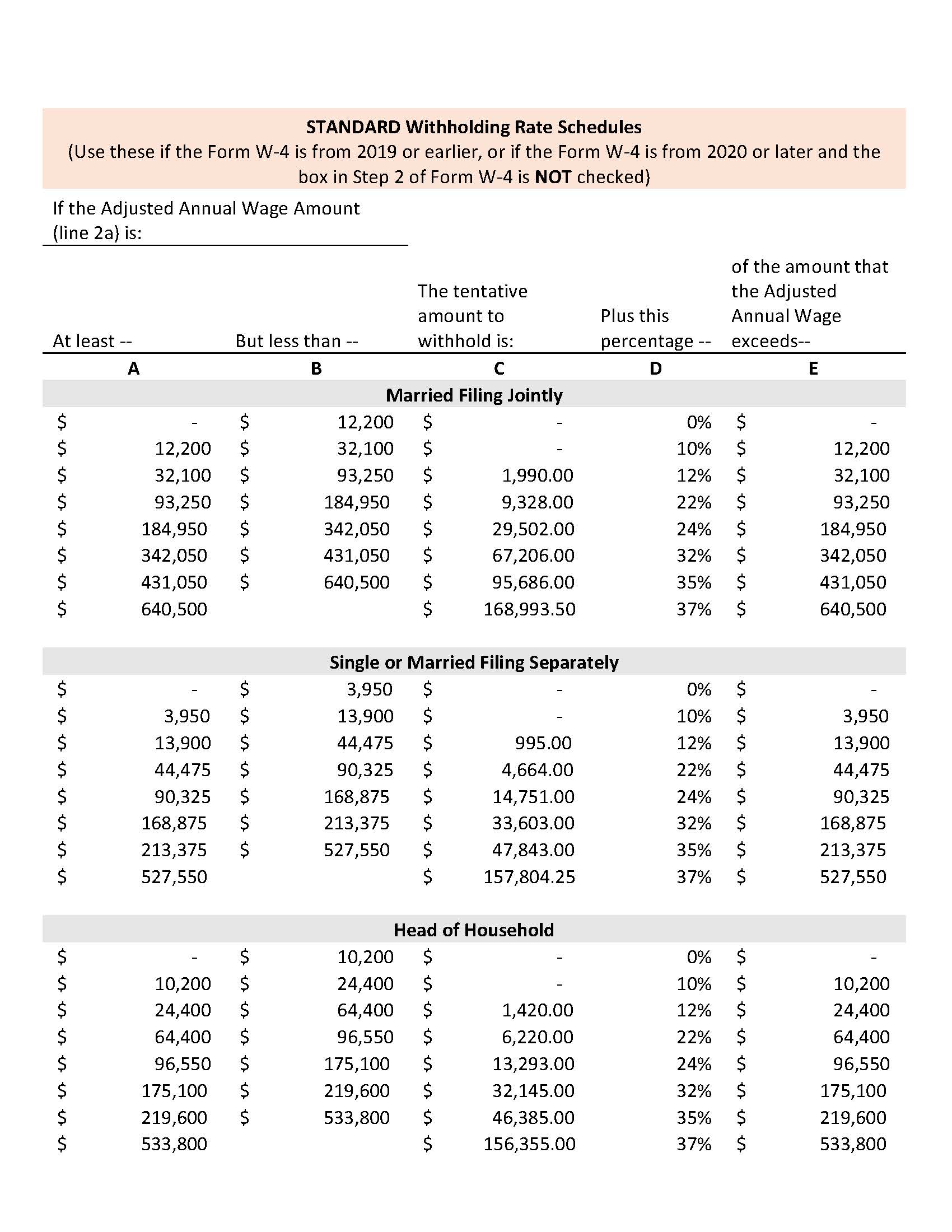

Social Security benefits depends on your age and the type of benefit for which you are applying. If you pay cash wages of 2300 or more for 2021 this threshold can change from year to year to any one household employee you generally must withhold 62 of social security and 145 of Medicare taxes for a total of 765 from all cash wages you pay to that employee unless you prefer to pay your employees share of social security and Medicare taxes from your own funds. Everyone pays the same rate regardless of how much they earn until they hit the ceiling.

1 There is no maximum taxable income for Medicare withholding. The employee tax rate for social security is 62 for both years. Both employees and employers pay FICA taxes at the same rate.

Other important 2021 Social Security information is as follows. The social security wage base limit is 142800The Medicare tax rate is 145 each for the employee and employer unchanged. The Social Security tax rate is 62 of wages for 2021.

125000 for married taxpayers filing a separate return plus. If your net earnings are less than 5880 you still may earn credit by using the optional method described later in this fact sheet. In 2021 if your net earnings are 5880 or more you earn the yearly maximum of four credits one credit for each 1470 of earnings during the year.

1410 earns one credit. 1 2021 the maximum earnings subject to the Social Security payroll tax will increase by 5100 to 142800up from the 137700 maximum for 2020 the Social Security. What Is Social Security Withholding.

For SE tax rates for. The social security tax rate is 62 each for the employee and employer unchanged from 2020. The social security wage base limit is 137700 for 2020 and 142800 for 2021.

Social security and Medicare tax for 2021. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus 145 Medicare tax on the first 200000 of wages 250000 for joint returns. The amount increased to 142800 for 2021.

Or Publication 51 for agricultural employers. Most people need 40 credits to qualify for retirement benefits. Hence the maximum amount of the employers Social Security tax for each employee in 2021 is 885360 62 X 142800.

You can earn a maximum of four credits each year. This maximum includes both employee wages and income from self-employment. Social Security functions much like a flat tax.

As of 2021 a single rate of 124 is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of 142800. For 2021 an employee will pay. Refer to Whats New in Publication 15 for the current wage limit for social security wages.

Social Security tax and Medicare tax. For earnings in 2021 this base is 142800. This is because he was not self-employed and his earnings in those three months are 1580 or less.

FICA Tax Rates 2021 FICA tax is a combination of social security tax and Medicare tax. For earnings in 2021 this base is 142800. For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad retirement tier 1 tax.

The Social Security maximum taxable income for 2021 is 142800. In the year you reach full retirement age we deduct 1 in benefits for every 3 you earn above a different limit but we only count earnings before the month you reach your full retirement age. The wage base limit is the maximum wage thats subject to the tax for that year.

The OASDI tax rate for wages paid in 2021 is set by statute at 62 percent for employees and employers each. Although his earnings for the year substantially exceed the 2021 annual limit 18960 John will receive a Social Security payment for July August and September. Only the social security tax has a wage base limit.

For 2021 that limit is 18960. If an employees wages salaries etc. 1470 earns one credit.

Thus an individual with wages equal to or larger than 142800 would contribute 885360 to the OASDI program in 2021 and his or her employer would contribute the same amount.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

2021 Wage Base Rises For Social Security Payroll Taxes

Social Security Wage Base Increases To 142 800 For 2021

What Are Employee And Employer Payroll Taxes Ask Gusto

Calculation Of Federal Employment Taxes Payroll Services The University Of Texas At Austin

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

How Much Social Security Tax Do I Pay The Motley Fool

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Maximum Taxable Income Amount For Social Security Tax Fica

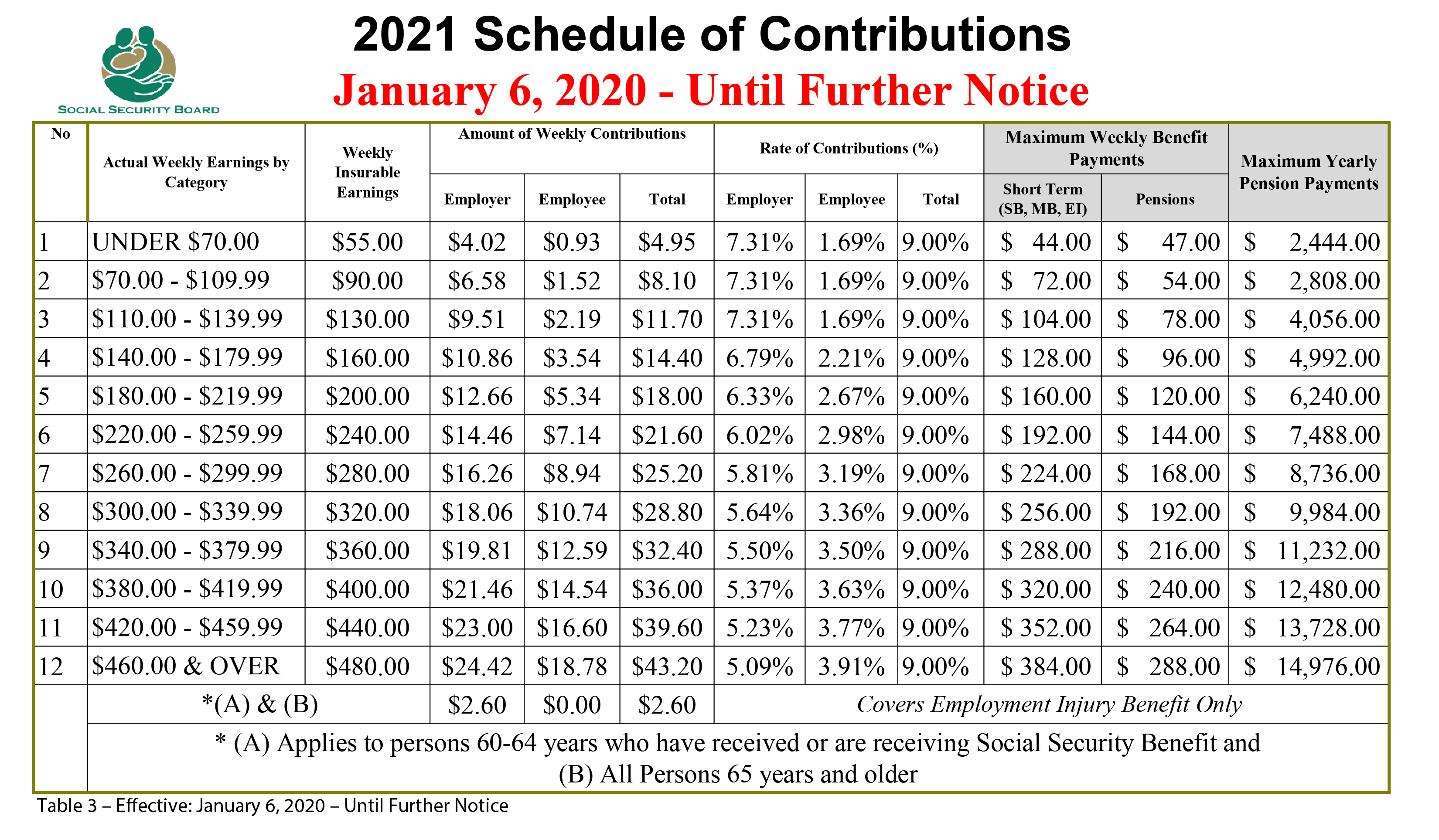

Contributions Social Security Board Belize

Your Bullsh T Free Guide To Taxes In Germany

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

2021 Wage Base Rises For Social Security Payroll Taxes

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Publication 926 2021 Household Employer S Tax Guide Internal Revenue Service

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Maximum Taxable Income Amount For Social Security Tax Fica

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

Post a Comment for "Social Security Employee Tax Limit 2021"