How To Reduce Social Security Tax On Paycheck

The Social Security tax rate in the United States is currently 124. One valuable strategy is tax deferral.

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

You have plenty of options.

How to reduce social security tax on paycheck. If youre above the thresholds you need to look at the components of your AGI says Donald. You can download the form or call the IRS toll-free at 1-800-829-3676 and ask for Form W-4V Voluntary Withholding Request. Manage Your Other Retirement Income Sources.

First lets address the Roth IRA. Social Security benefits are included with other taxable income at the rate of 85 50 or zero. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Most retirees are looking to pull money from their IRAs rather than put it. If you are deaf or hard of hearing call the IRS TTY number 1-800-829-4059 When you complete the form you will need to select the percentage of. Withdrawals from a traditional IRA are included in income and fully taxable.

In the year you reach full retirement age we deduct 1 in benefits for every 3 you earn above a different limit but we only count earnings before the month you. Those values can be found on your 1040 tax form. For 2021 that limit is 18960.

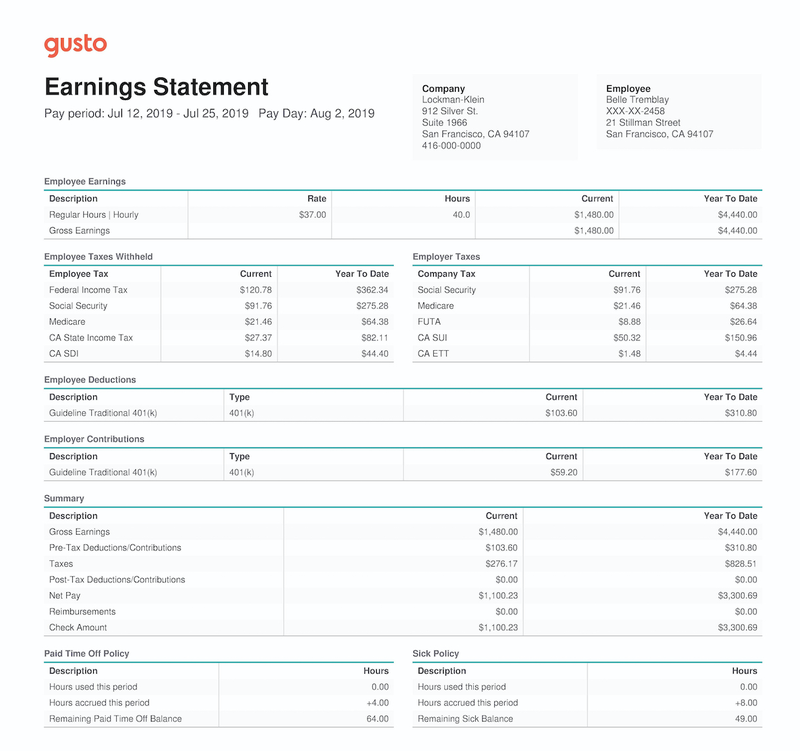

Move income-generating assets into an IRA. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total. The amount of Social Security wages is the basis of your benefit determination.

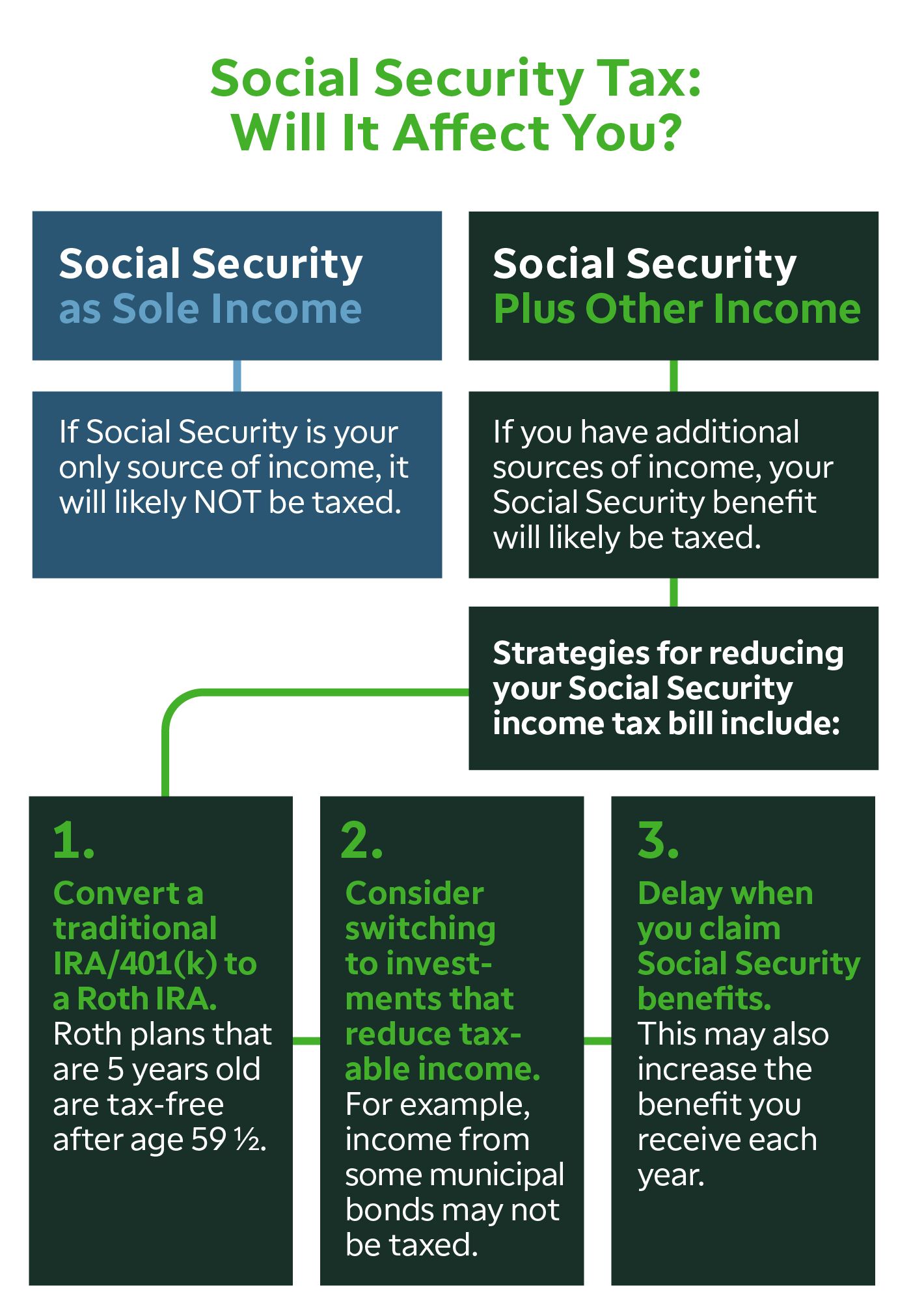

Try to avoid recognizing any income that isnt needed for spending. The Federal Insurance Contributions Act FICA mandates the collection of Social Security tax. Ways to Reduce or Eliminate Social Security Tax.

If youre receiving partnership income or other business income see if you can minimize it. However you only pay half of this amount or 62 out of your paycheck -- the other half is paid by your employer. We use the following earnings limits to reduce your benefits.

Another way to minimize your taxable income when drawing Social Security is to maximize or at least increase your taxable income in the years before you begin to receive benefits. To calculate that add your adjusted gross income plus non-taxable interest plus half of your Social Security benefits. To give people a needed temporary financial boost the Coronavirus Aid Relief and Economic Security Act allowed employers to defer payment of the employers share of Social Security tax.

Reducing adjusted gross income will reduce the tax on benefits. You could be in. If you file as an.

Strategies to Lessen the Tax Hit To lower the tax you have to reduce your overall taxable income. Your benefits are not taxed if your income falls below 32000 married filing jointly or 25000. Refer to Publication 15 Circular E Employers Tax Guide for more information.

IRS Notice 2020-65 PDF allowed employers to defer withholding and payment of the employees Social Security taxes on certain wages paid in calendar year 2020. Retirees who have income from another source in addition to Social Security. If you are under full retirement age for the entire year we deduct 1 from your benefit payments for every 2 you earn above the annual limit.

Save in a Roth. Another option is to convert an investment that earns taxable income such as a taxable bond portfolio into a tax-deferred account such as a deferred annuity. Social Security benefits become taxable if the sum of your adjusted gross income.

Strategies that reduce adjusted gross income in fact will reduce both regular income taxes and the amount of taxable benefits. Social Security and Medicare Withholding Rates. Therefore these withdrawals which increase your income may increase your social security taxes.

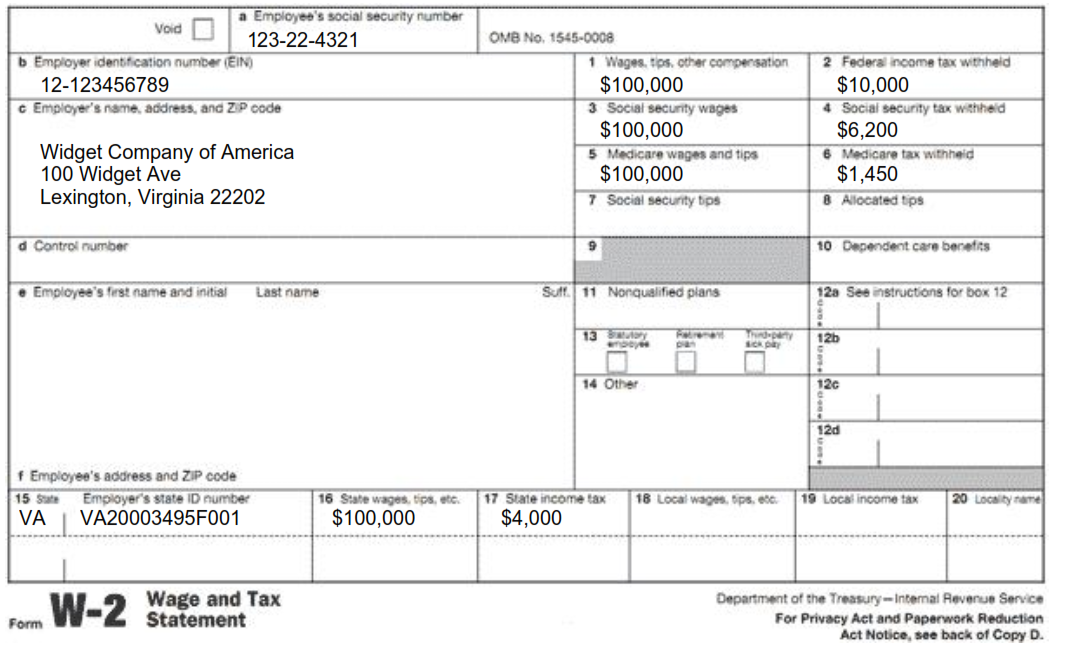

You could structure the annuity to begin paying income in a few years when you expect your taxable income as well as your overall tax rate to decline. If you live in one of the states that taxes your Social Security income the easiest way to save on your tax bill is simply to move to a different location in retirement. The Social Security tax that Payroll withholds is based on a percentage of the line item shown on your W-2 Form as Social Security wages which equates to gross pay minus deductions not subject to Social Security tax.

How to minimize taxes on your Social Security 1. Pretax deductions that reduce Social Security. How to Minimize Social Security Taxes Stay Below the Taxable Thresholds.

Understanding Your W 2 Controller S Office

Social Security Taxes 3 Ideas To Help Minimize The I Ticker Tape

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

Gross Wages What Is It And How Do You Calculate It The Blueprint

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

When Do High Income Earners Stop Paying The Social Security Payroll Tax Center For Economic And Policy Research

How Changing Social Security Could Affect Beneficiaries And The System S Finances Congressional Budget Office

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding Tax Season Form W 2 Remote Financial Planner

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Pay Statement Office Of Human Resources

/GettyImages-1158399390-278304dab763466e88c8eb626f4a50d0.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Understanding Tax Season Form W 2 Remote Financial Planner

Understanding Your Paycheck Credit Com

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Where Do My Social Security Tax Dollars Go A Breakdown By Percent

Post a Comment for "How To Reduce Social Security Tax On Paycheck"