Social Security Employee Tax Limit 2020

For 2020 the first 137700 of your combined wages tips and net earnings is subject to any combination of the Social Security part of self-employment tax Social Security tax or railroad retirement tier 1 tax. If an employees 2020 wages salaries etc.

Somebody Stopped Paying Their Social Security Taxes Today

You can earn a maximum of four credits each year.

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

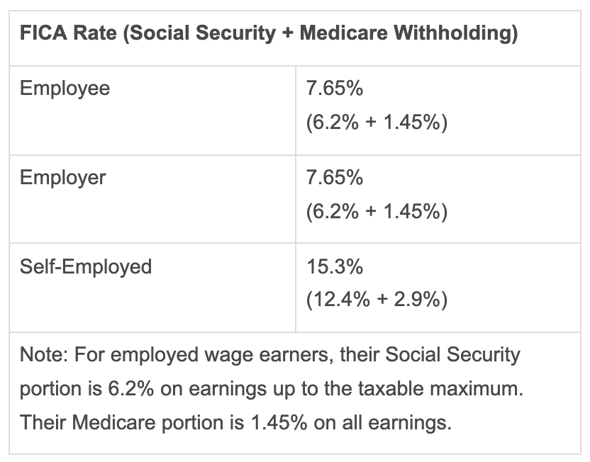

Social security employee tax limit 2020. Only the social security tax has a wage base limit. The social security wage base limit is 137700 for 2020 and 142800 for 2021. The 765 tax rate is the combined rate for Social Security and Medicare.

In 2021 this limit is 142800 up from the 2020 limit of 137700. Refer to Whats New in Publication 15 for the current wage limit for social security wages. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020.

It was increased from 132900 to 137700 in 2020 and to 142800 for 2021. As a result in 2021 youll pay no more than 885360 142800 x 62. Or Publication 51 for agricultural employers.

Also as of January 2013 individuals with earned income of. Exceed 137700 the amount in excess of 137700 is not subject to the Social Security tax. As of 2021 your wages up to 142800 137700 for 2020 are taxed at 62 for Social Security and your wages with no limit are taxed at 145 for Medicare.

Employers Social Security Payroll Tax for 2021. Maximum income subject to social security tax. 1410 earns one credit.

Social Security benefits include monthly retirement survivor and disability benefits. The wage base limit is the maximum wage thats subject to the tax for that year. The Social Security maximum taxable income for 2020 is 137700.

If you are working there is a limit on the amount of your. What Is the Social Security Tax Limit. The Social Security portion OASDI is 620 on earnings up to the applicable taxable maximum amount see below.

Other important 2020 Social Security information is as follows. You arent required to pay the Social Security tax on any income beyond the Social Security Wage Base. Social Security benefits depends on your age and the type of benefit for which you are applying.

For earnings in 2021 this base is 142800. Information for people who receive Social Security benefits. The Medicare portion HI is 145 on all earnings.

There is no limit on covered self-employment income that will be subject to the Medicare tax. This is the largest increase in a decade and could mean a higher tax. 1 There is no maximum taxable income for Medicare withholding.

Based on the increase in the Consumer Price Index CPI-W from the third quarter of 2018 through the third quarter of 2019 Social Security and Supplemental Security Income SSI beneficiaries will receive a 16 percent COLA for 2020. The Social Security maximum taxable income for 2021 is 142800. Separate HI taxable maximums of 125000 130200 and.

The Social Security tax rate remains at 62 percent. The Social Security wage base for self-employed individuals in 2020 will also be 137700. Your employer matches those amounts.

For 2020 the maximum limit on earnings for withholding of Social Security old-age survivors and disability insurance tax is 13770000. Most people need 40 credits to qualify for retirement benefits. The amount increased to 142800 for 2021.

New refundable credits are available to certain self-employed persons impacted by the coronavirus. 8 rows Maximum Taxable Earnings. 1470 earns one credit.

The OASDI tax rate for self-employment income in 2021 is 124 percent. There is no limit on the amount of earnings subject to Medicare hospital insurance tax. Hence the maximum amount of the employers Social Security tax for each employee in 2020 is 853740 62 X 137700.

For 2020 the maximum amount of self-employment income subject to social security tax is 137700. Whats the Current Social Security Withholding Maximum. The maximum Social Security tax employees and employers will each pay in 2020 is 853740.

This is an increase of 29760 from 823980 in 2019. Tax Tip 2020-76 June 25 2020 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. For Medicares Hospital Insurance HI program the taxable maximum was the same as that for the OASDI program for 1966-1990.

They dont include supplemental security income payments which arent taxable. The resulting maximum Social Security tax for 2020 is 853740. The Social Security Tax Wage Base All wages and self-employment income up to the Social Security wage base are subject to the 124 Social Security tax.

Credits for self-employed persons. The wage base is adjusted periodically to keep pace with inflation. The employee tax rate for social security is 62 for both years.

For SE tax rates for.

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

2020 Instructions For Schedule H 2020 Internal Revenue Service

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

2021 Wage Base Rises For Social Security Payroll Taxes

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

Income Limit For Maximum Social Security Tax 2021 Financial Samurai

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

2020 Instructions For Schedule H 2020 Internal Revenue Service

Publication 926 2021 Household Employer S Tax Guide Internal Revenue Service

Social Security Tax Cap 2021 Here S How Much You Will Pay

Understanding Your W 2 Controller S Office

2021 Wage Base Rises For Social Security Payroll Taxes

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Are Employee And Employer Payroll Taxes Ask Gusto

Social Security Wage Base Increases To 142 800 For 2021

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Post a Comment for "Social Security Employee Tax Limit 2020"