Can Social Security Be Included In Ppp

The total number of employees of the business any. I reviewed an SBA webinar last month and the SBA representative said that if our business an S Corporation had not yet paid its employers match yet for our 401K participants for 2019 and since we have extended our 2019 Corporate Tax Return until September 2020 the SBA representative said that the 2019 Employer Matching Contributions would be included in the PPP.

Are part-time or seasonal employees included in the payroll costs.

Can social security be included in ppp. For a pay period that is all or in part of the covered period or alternative covered period and which is paid on the next regularly scheduled pay date after the end of that period may also be included. This amendment applies as if it were in the. Under the CARES Act compensation of employees whose principal place of residence is outside the US.

3 How do you give an employee a bonus. Are not to be included in payroll costs If you have such employees then you will need to exclude their compensation from the payroll costs as shown in the report. Section 2301g1 of the Coronavirus Aid Relief and Economic Security Act CARES Act as amended by the Tax Certainty and Disaster Tax Relief.

7 What is the bonus tax rate for 2021. Can you prepay rent. Again employers that apply for a PPP loan must stop deferring Social Security tax payments when they receive an issuance from their lender that says their PPP.

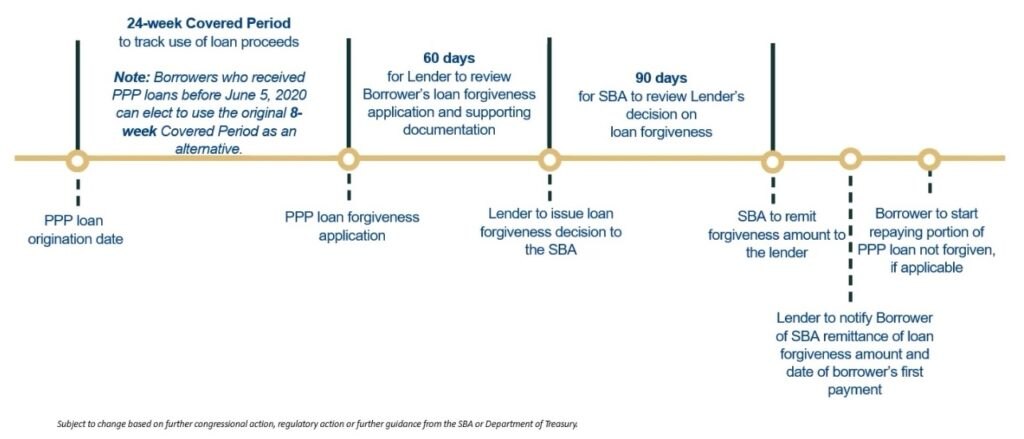

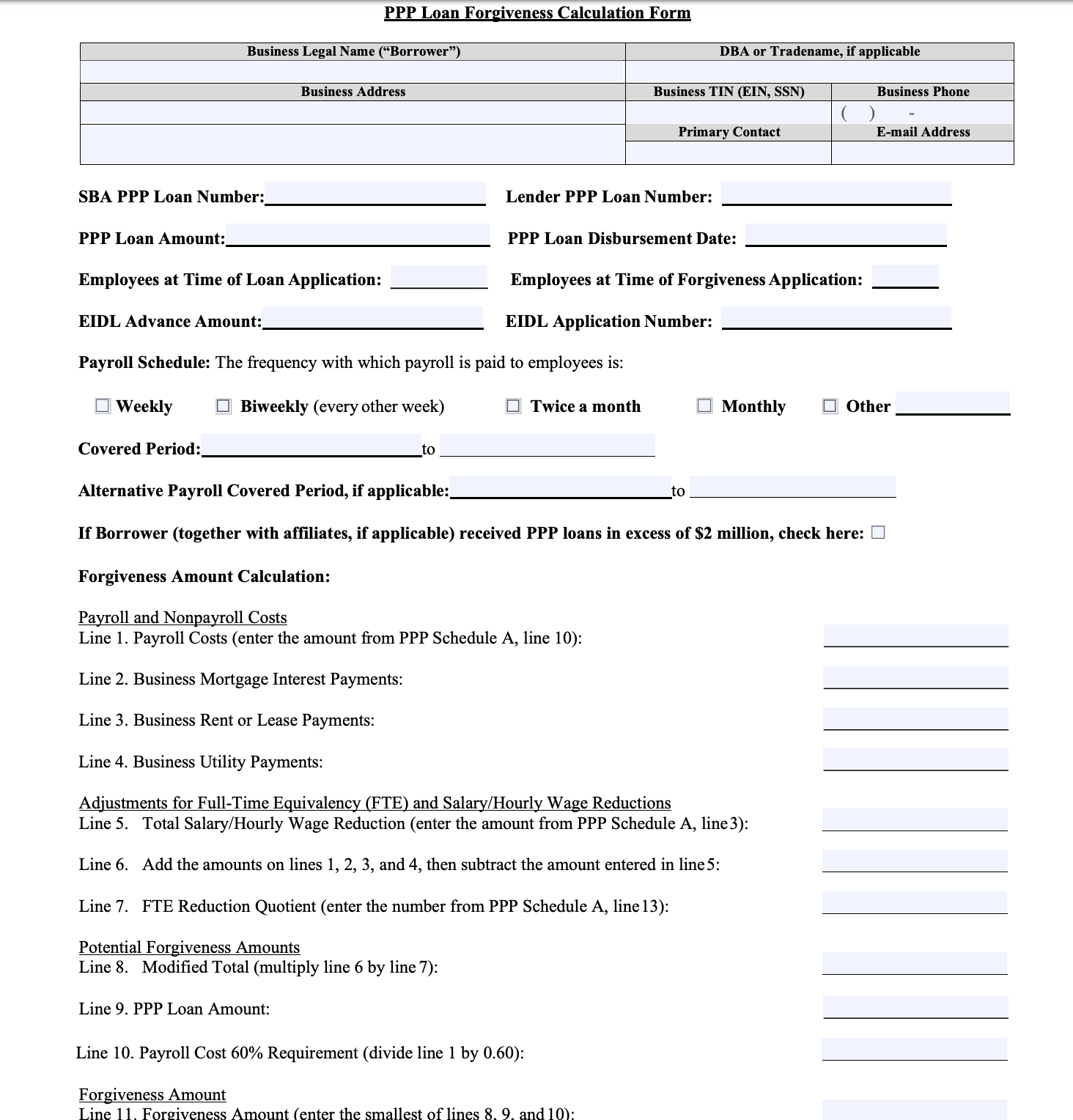

Lenders have 60 days to make a decision on loan forgiveness. Employers can defer SS tax payments that are due from March 27 2020 December 31 2020. On both the beginning of the chosen covered period as well as the end of it the compensation component of payroll costs cannot be double-counted duh.

Each business that was existing and paying payroll and payroll taxes on or before February 15 2020 with no more than 500 employees or the size standard in number of employees that may be established by the SBA can apply for the new PPP loans. The number of employees would need to be added across all the businesss affiliates ie. Is there any standard language that should be included when replying to a Form 3509 or 3510.

A business can qualify if it meets the SBA employee-based or revenue-. As a reminder the deferred Social Security tax payments are due December 31 2021 50 of the deferred amount and December 31 2022 remaining amount. In other words the clock is ticking and you need to make sure you document every expense as soon as you receive fundsor you could run the risk of losing the loan forgiveness.

How can I maximize the employee retention credit while still achieving full PPP loan forgiveness. Congress passed The Coronavirus Aid Relief and Economic Security Act CARES Act which included the Paycheck Protection Program PPP for small businesses. Borrowers have 10 months from the end of their covered period to apply for forgiveness before they would need to start paying back any portion of their loan.

8 What is the standard deduction for seniors for 2020. The exclusion of compensation in excess of 100000 annually applies only to cash compensation not to non-cash benefits including. 4 How do I enter bonus on ADP.

These FAQs make clear that employers who received a paycheck protection program PPP loan may not defer the deposit and payment of the employers share of Social Security tax that is otherwise due AFTER the employer received a decision from the lender that the loan was forgiven In other words businesses who receive PPP loans may defer social security tax payments 62 up. 5 How are ADP bonuses. In addition the COVID-19 relief law passed by Congress in December 2020 provides that the forgiven portion of a PPP loan can be excluded from gross income.

6 Does bonus get taxed differently. Are benefits such as healthcare 401k and payment of state and local taxes included in the 100000 per employee cap. 2 Is bonus included in salary.

The guidance states that funds are for expenses incurred or paid during the covered. Small business concerns can be eligible borrowers even if they have more than 500 employees as long as they satisfy the existing statutory and regulatory definition of a small business concern under section 3 of the Small Business Act 15 USC. Workers compensation insurance premiums are not included as the covered expenses for the PPP loan forgiveness.

1 Can bonuses be included in PPP. The PPP was created by the CARES Act and originally included 349 billion in funding. Loans are made by.

The lender according to the SBA must make the first disbursement within 10 calendar. Next while federal unemployment FUTA and Social SecurityMedicare. All employees paid during the period of time are included in payroll costs.

As such PPP loan recipients now can take advantage of the additional time to pay the employment share of Social Security tax for its workforce. How do I account for PPP loans in my financial statements. We would not recommend pre paying expenses.

The PPP provides short-term cash flow assistance to small businesses and other eligible entities to help these businesses and their employees deal with the immediate economic impact of the COVID-19 pandemic. 10 What is the income limit for Social Security in. 9 What is the standard deduction for over 65 in 2020.

Can Workers Compensation Insurance premiums be included as part of payroll expense. PPP funds are intended to cover your payroll expenses for the eight-week period following the first disbursement of the PPP funds. However that money was gone within two weeks resulting in the second round of funding totaling 320 billion.

Pin On Social Security Disability

Paycheck Protection Program Ppp Qualified Expenses

Providers Can Now Get More Money From The Ppp Tom Copeland S Taking Care Of Business

Ppp Forgiveness Series Part 3 A Visual Timeline Bbva

Ppp Second Draw Loans Ppp2 Ppp Loan Consulting

How To Fill Out Your Ppp Forgiveness Application Form Simplifi Payroll And Hr

Paycheck Protection Porgram Extension Bill Signed Into Law Blue Co Llc

Pin On Careers Employers Employees

Faqs On The Paycheck Protection Program Ppp For Food Service And Accommodation Franchisees White Case Llp

3 Things About Small Businesses Ppp Loan Forgiveness

Ppp Forgiveness Apply Now Or Wait

Covid 19 Relief Programs Northwest Bank

Faqs On The Paycheck Protection Program Ppp For Food Service And Accommodation Franchisees White Case Llp

Paycheck Protection Program Documents Needed To Apply Bluevine

Getting Paid For Doing Financial Planning At A Broker Dealer Financial Planning Financial Coach Financial Advisors

Paycheck Protection Program Ppp Loan Forgiveness Solution

Topic No 751 Social Security And Medicare Withholding Rates Social Security Medicare Internal Revenue Service

Post a Comment for "Can Social Security Be Included In Ppp"